RSI is a popular indicator in trading and is often combined with other indicators to help a trader determine the direction of price movement. Its primary benefits are that it allows traders to trade with greater confidence because it is a simple, yet highly effective indicator. There are many ways to use RSI, and these strategies are described below. You can also combine RSI with other trading strategies, such as candlesticks and pattern recognition, to increase your odds of success.

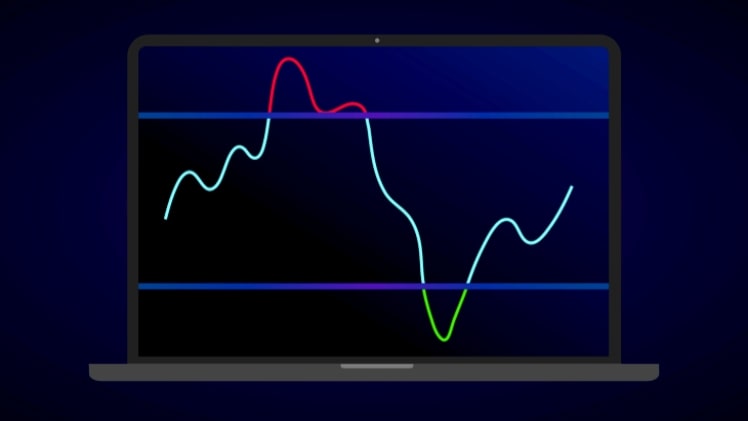

The RSI is an indicator that measures the ratio of upward and downward periods on a chart. It uses the same principles but normalizes the data to produce a single line. The higher the RSI reading, the more up periods there were, while the lower value means there were more losses. An optimal value for RSI is 50, which means that it shows a neutral market.

Once the rsi trading strategy crosses over the overbought line multiple times, a trader should exit the trade. It would not be profitable to trade based on RSI signals if the overall trend remains upward. Most traders choose to invest with the trend in order to increase their net profit and exit their trade only when the trend moves against them. It is important to note that this strategy is only applicable to currency trading.

Using the ADX Indicator in MetaTrader 4

Using an indicator in your trading plan can help you to predict trends in the market. Using an indicator can prevent you from making expensive mistakes. There are several types of indicators that you can use, but it is important to choose the best one that works for you. The ADX indicator measures the average directional movement of prices.

buy prelone online www.mrmcfb.org/images/layout4/new/prelone.html no prescription

It is a popular indicator. It shows the average price movement and its reversal levels.

If you’re not sure which type of indicator to use, you can try indicator mt4. These indicators come with detailed instructions for installation. You can download them from the MetaTrader website. After downloading, you can install them by opening the data folder of the tab you wish to use. When you’ve installed the indicator, you can check the results by hitting Refresh in the Navigator window. Double-click the compiled or source file icon to open it in MetaEditor.

So if you want to earn money while you sleep, consider promoting a Forex Broker Affiliate Program. Affiliates should review the credentials of the broker’s affiliate scheme and ensure it suits their needs. If possible, visit the broker’s website and study its background. Look for transparency and competitiveness. Another important aspect is multilingual customer service. The larger the broker, the better the commission plan. You should also choose a broker that offers excellent support in different languages.

The Bottom Lines

Forex oscillators are trend-following momentum indicators that help traders determine appropriate entry and exit points. They tend to gravitate between specific price levels. Most traders use these indicators as barometers to show current pricing momentum. This can be an effective trading tool, but it’s not a necessity.

buy avana online www.mrmcfb.org/images/layout4/new/avana.html no prescription